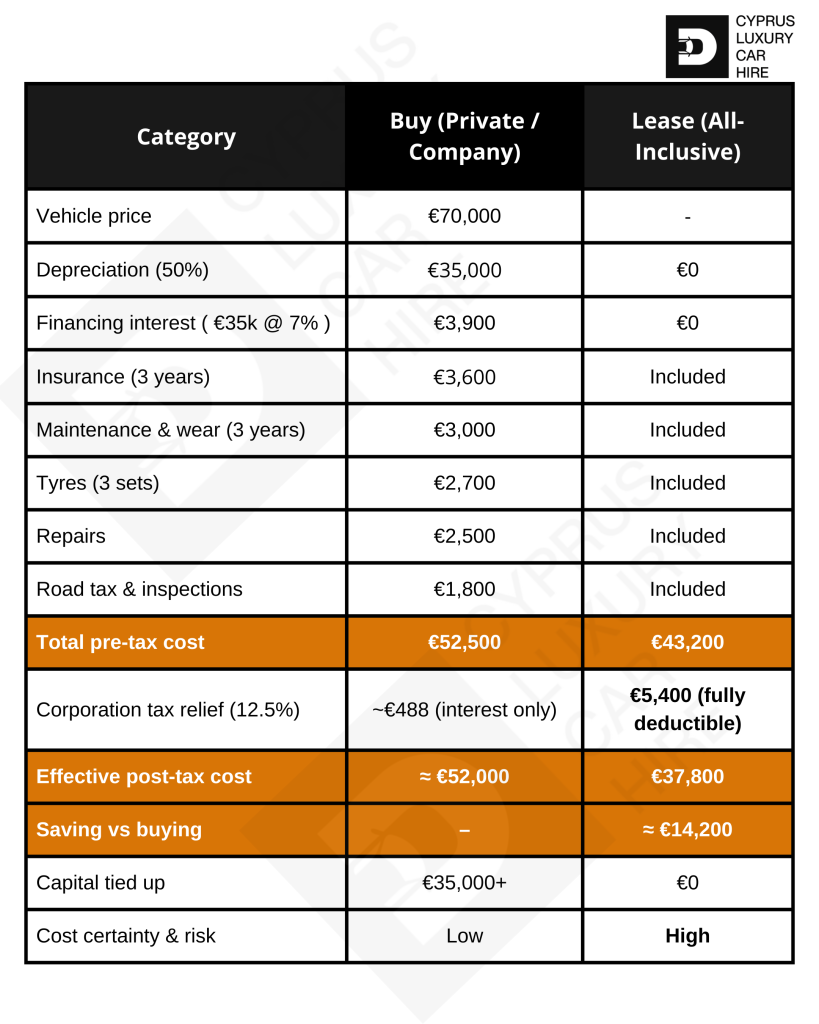

For private users, leasing removes the two biggest ownership risks: depreciation and unpredictability. On a €70,000 GLE, a realistic 50% value loss equates to €35,000 gone over three years. When insurance, maintenance, tyres, repairs and financing interest are added, buying costs around €52,500 over 36 months. By contrast, an all-inclusive lease at €1,200 per month (€43,200 total) saves approximately €9,300, while fixing every cost upfront and preserving €70,000 in personal liquidity.

For business users, the advantage is even stronger. Lease payments are 100% deductible, delivering €5,400 in corporation tax relief at a 12.5% tax rate, reducing the effective post-tax lease cost to €37,800. Buying offers minimal tax efficiency by comparison, with only finance interest deductible, resulting in a post-tax ownership cost of approximately €52,000. The tax-adjusted saving with leasing exceeds €14,000 over three years, alongside cleaner accounting and no balance-sheet depreciation exposure.